ITR Filing Deadline 2025: Now Even BJP MPs Write to Finance Minister to Extend Income Tax Return Filing Due Date

The deadline for filing Income Tax Returns (ITR) for the assessment year 2025-26 is approaching fast, and the growing chorus demanding an extension is gaining momentum. What began as appeals from tax professionals, chartered accountants, and trade bodies has now found support among lawmakers of the ruling Bharatiya Janata Party (BJP). Several BJP Members of Parliament (MPs) have reportedly written to Finance Minister Nirmala Sitharaman, requesting an extension of the ITR filing due date to provide relief to taxpayers, particularly small businesses and salaried individuals grappling with compliance challenges.

The Current Deadline

For individual taxpayers not subject to audit, the last date to file ITR remains July 31, 2025, unless the government announces an extension. For those requiring audits, the deadline is October 31, 2025. Historically, the Finance Ministry has extended deadlines in cases where technical glitches, natural calamities, or disruptions caused by policy changes made timely filing difficult. However, in recent years, the government has insisted on sticking to the deadline, urging taxpayers to avoid last-minute rush.

Why Calls for Extension Are Growing

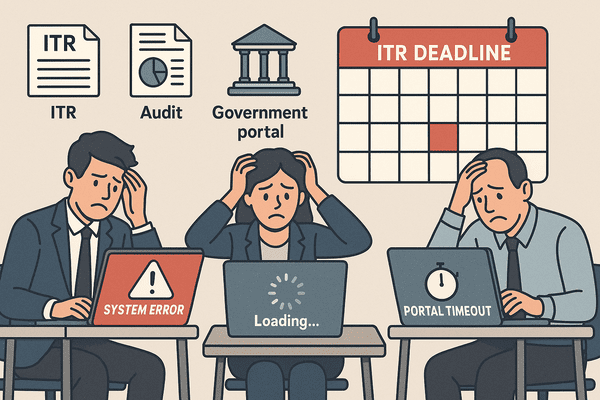

1. Technical Glitches on the Income Tax Portal

Despite continuous improvements, many taxpayers have complained of difficulties accessing the Income Tax e-filing portal. Issues like slow server response, OTP mismatches, and delayed validation of pre-filled data have been reported. Chartered accountants argue that these glitches slow down the filing process and lead to unnecessary stress for both professionals and taxpayers.

2. High Compliance Burden

Over the past few years, taxpayers have been burdened with multiple overlapping compliance requirements. Apart from filing ITR, individuals and businesses must ensure correct reporting of TDS (Tax Deducted at Source), GST filings, and other statutory submissions. Small traders and self-employed professionals argue that completing these obligations within the same timeframe is challenging.

3. Overlap With Audit Season

For professionals handling both ITR filings and statutory audits, July is considered a peak period. Tax practitioners claim that overlapping deadlines create undue pressure, especially when audits require significant documentation and cross-checking.

4. Monsoon Disruptions in Several States

Heavy rainfall and flooding in parts of India, particularly in the Northeast, Maharashtra, and Bihar, have hampered normal business operations. Several trade associations from these regions have written to the Finance Ministry, highlighting that businesses are unable to meet deadlines due to disrupted connectivity and loss of records.

5. Support From Lawmakers

What has made the issue politically significant is the intervention of BJP MPs. According to sources, these lawmakers conveyed to the Finance Minister that taxpayers, particularly in smaller towns and rural areas, are struggling to file returns on time. The MPs emphasized that a short extension of 30 to 45 days would help ease the burden without affecting overall tax collections.

Past Precedents

The demand for extensions is not new. In 2021 and 2022, the Finance Ministry extended the ITR deadlines due to the COVID-19 pandemic and technical glitches on the new portal launched by Infosys. However, since 2023, the government has avoided granting extensions, arguing that adherence to deadlines improves compliance discipline. Officials also highlight that timely filing ensures early processing of returns and faster refunds for taxpayers.

The Government’s Dilemma

The Finance Ministry now faces a tricky situation. On one hand, it wants to maintain fiscal discipline and discourage last-minute filing habits. On the other, ignoring appeals from its own party MPs could send a negative message to small businesses and middle-class taxpayers ahead of upcoming state elections. A decision is expected soon, and the Finance Minister may weigh both political and economic considerations before announcing any relief.

Reactions From Stakeholders

- Chartered Accountants: The Institute of Chartered Accountants of India (ICAI) has formally urged the government to extend the deadline, citing workload pressures and portal issues.

- Business Associations: Chambers of commerce and MSME groups have written petitions highlighting that an extension would prevent errors and penalties arising from rushed filings.

- Taxpayers: On social media, many salaried employees and freelancers have been requesting more time, with hashtags like #ExtendDueDate trending on X (formerly Twitter).

- Opposition Parties: Leaders from opposition parties have seized the moment to accuse the government of being insensitive to taxpayer concerns, urging immediate relief.

What Happens If Deadline Is Not Extended?

If the July 31 deadline is not extended, taxpayers who fail to file on time will face penalties under Section 234F of the Income Tax Act. The late filing fee ranges from ₹1,000 to ₹5,000, depending on income levels. Additionally, late filers may have to pay interest on unpaid taxes and will lose the benefit of carrying forward certain losses. This is why many taxpayers are urging the government to avoid penalizing genuine delays caused by external factors.

The Road Ahead

While the government has not yet made an official announcement, experts believe that the Finance Ministry may offer a short extension of 15 to 30 days, balancing discipline with relief. If granted, it would not be the first time such a move has been made close to the deadline. However, if the government holds firm, taxpayers will need to act quickly to avoid penalties.

The debate over extending the ITR filing deadline 2025 reflects larger concerns about India’s tax compliance ecosystem. The fact that even BJP MPs have joined the call for an extension underscores the seriousness of the issue. For now, taxpayers, professionals, and businesses await the Finance Minister’s decision, which could come in the next few days. Regardless of the outcome, one thing is clear—streamlining compliance and addressing technical bottlenecks will remain crucial for India’s tax administration in the years ahead.